IDEXX: The Size Of The Fight In The Dog - Seeking Alpha

Image Source: freerangestock.com - Free Commercial Images

Readers seem to be very interested in IDEXX (IDXX) but authors haven't covered the name with the frequency demanded by demand. A decision was then made to update my previous article on the company. But please note that certain aspects of the business haven't changed much since the first article was published back in August 2019: for instance, IDEXX's competitive advantages, core markets, reporting segments, and so on are (as expected) unaltered. Still, as new readers might benefit from the analysis, these 'evergreen' aspects will be covered once again in the following article.

Please skip the following introduction if you have read my previous articles.

Introduction

It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price."

Whether we're talking about socks or stocks, I like buying quality merchandise when it is marked down."

- Warren Buffett

What is a wonderful company, and what is 'quality merchandise' from an investing standpoint? The most constructive definition to address this question is Warren Buffett's concept of "economic moat", a long-lasting competitive advantage that allows a given company to harvest above-average returns on its capital, even when faced with economic downturns or powerful competitors.

A quality investing strategy should, therefore, capture the fundamental nature of Buffett's philosophy. Here, the aim is to identify high-quality stocks - or "compounders" - trading at reasonable prices by calculating a simple Quality Score based on 12 fundamental factors related to the actual business and its intrinsic economic characteristics. These are (possibly) the qualitative and quantitative factors that best capture the elusive 'quality dimension' of a specific company, at least according to Buffett and other investors in these best-of-breed companies like Charlie Munger, Chuck Akre, and Joel Greenblatt. The intention is not to discuss fleeting quarterly results (far from it) but rather to analyze and find superior companies and business models capable of compounding value for many years into the future. To calculate the Quality Score, the following questions will be addressed:

1) Presence of strong and enduring competitive advantages; 2) Favorable market dynamics and relative positioning; 3) Presence of multiple and complementary sources of revenue; 4) Presence of market leadership; 5) Presence of pricing power; 6) Presence of high and persistent Cash Returns on Invested Capital; 7) Strong cash-generation ability; 8) Presence of superior gross profitability; 9) Presence of superior revenue growth; 10) Absence of systemic and company-specific risk factors with the potential to compromise the firm's future; 11) Presence of a solid financial position, with little debt.

To calculate the Quality Score, one (1) point is awarded when the answer is fundamentally positive ("Yes"); minus one (-1) point is subtracted when the answer is essentially negative ("No"); no points are added or subtracted (0) when there is too much uncertainty or when negative and positive factors are essentially in equilibrium. 'High-quality companies' are the ones with a Quality Score of "6" or above. Let us then calculate the Quality Score for IDEXX Laboratories.

1. Does IDEXX have strong and durable competitive advantages over competitors? Yes: 1 Point

IDEXX has been at the forefront of the veterinary diagnostics market since the company's foundation in the Eighties. IDEXX started with the production of diagnostic tests targeted mostly at poultry producers but it soon diversified into other businesses within the animal healthcare space. Thanks to a first-mover advantage, customer-centric attitude and relentless culture of innovation, the firm's cutting-edge offerings gradually became entrenched in the everyday practices of its growing base of customers.

Competitive Advantages | Customer Switching Barriers

This entrenchment is largely a result of strong customer switching barriers imposed by the firm's razor-and-blades business model: once a purchaser acquires testing machines provided by IDEXX (the analyzers, which are the 'razors'), this purchaser can only use compatible consumables provided by IDEXX (the 'blades'). As expected, analyzers and their respective consumables are designed to operate as a single system, and each different analyzer performs different types of tests on specific biologic samples (like blood or urine). Switching barriers rise even higher when the customer acquires several of these different analyzers, as it is often the case.

The firm's software offerings also promote client retention because they are deeply integrated with an array of mission-critical apps and services such as IDEXX's VetConnect PLUS, a cloud-based technology that allows veterinarians to access and analyze data from all of the company's diagnostic modalities; an attractive proposition used in over 100 countries, VetConnect PLUS allows practitioners to see and trend diagnostic results, enabling greater insight and better decision-making. Of course, given the financial costs involved, as well as the length of time required to master a competing software solution, a switch from IDEXX's software becomes increasingly unlikely as vets become increasingly proficient at using it; moreover, IDEXX's software solutions (which are fully integrated by its Cornerstone software) are also used to keep pertinent data on a certain animal/patient - being so, a switch would invite potential disruption and loss of key clinical information.

Competitive Advantages | Cost Advantages

Animal diagnostic testing services comprise two distinct lines of business: the provision of equipment, software and consumables that enable vets to carry out tests within their practices (the 'in-house' or 'in-clinic' business); and the provision of testing services by reference labs, whereby the veterinary sends biologic samples to these labs so that different tests can be performed (the 'external lab' business). Because external services provide a larger (and in some cases more accurate) range of diagnostic assessments, almost all practices use a combination of in-house and lab testing.

With a footprint that now covers every continent except Antarctica, IDEXX currently owns and operates one of the larger networks of such external reference labs. Unsurprisingly, this extensive network generates sizable cost advantages on account of its scale, strategic placement, geographic density, and voluminous throughput. A cost-effective lab network requires a multiplicity of regional locations outfitted with expensive equipment, highly differentiated professionals (namely pathologists, which are in short supply) and couriers capable of visiting clinics once or twice per day - combined with the stringent long-term contracts established between IDEXX and the veterinary practices, such upfront costs and difficult logistics act as powerful deterrents to new entrants, no matter how large or how well capitalized they may be. IDEXX's scale, financial muscle, and accumulated experience also facilitate the integration of newly-acquired, previously independent lab businesses. Trying to replicate IDEXX's far-reaching lab network would be a costly and uncertain undertaking for most competitors.

2. Is IDEXX a diversified company, with multiple and complementary sources of revenue? Yes: 1 Point

IDEXX operates through 3 main business segments: 1) the Companion Animal Group (CAG) business, which sells diagnostic and information technology-based solutions for the veterinary market; 2) the Livestock, Poultry and Dairy (LPD) segment, which offers products and services for livestock and poultry health, as well as solutions to ensure the quality and safety of food and milk; and 3) the Water segment, which commercializes products that test water for microbiological contaminants (a fourth and much smaller segment combines products for the human point-of-care diagnostics market).

In 2019, the CAG segment was responsible for the vast majority of sales (approximately 88%), whereas together the LPD and Water segments only accounted for about 12% of revenues. This doesn't mean, however, that IDEXX's portfolio is unbalanced - in fact, because the leading CAG segment aggregates everything from software, to reference labs, to consulting services and to a multitude of diagnostic solutions (which include instruments, consumables, and rapid assay test kits) this discrepancy between the of sales of each segment is to be expected.

The company's extensive portfolio offers ample optionality and long avenues for future growth; moreover, the breadth of IDEXX's full diagnostic solutions provides customers with a unique, high-value proposition currently unmatched by the competition. And thanks to its large and expanding installed base of solutions, recurring diagnostic revenue generated by the CAG segment now accounts for about 76% of IDEXX's consolidated sales. In aggregate, IDEXX makes close to 90% of its sales from recurring sources.

3. Is IDEXX dominant within its core markets? Yes: 1 Point

With 60%-plus market share, IDEXX is the undeniable global leader in veterinary diagnostic tests and instruments; on its part, Zoetis occupies a distant second place with approximately 30% share (through Abaxis), whereas Heska only controls about 6%-9% of this market. IDEXX is especially dominant in rapid assay test kits and point-of-care (POC) diagnostic instruments, an area where the company boasts a remarkable 96%-99% customer retention rate. In reality, the company is the global frontrunner in each of the in-clinic analyzer markets, a profitable arena where it benefits from barriers to switching, barriers to entry, and limited bargaining power on the part of customers. The firm's leading position can be attributed not only to its strong competitive advantages but also to its R&D prowess and far-reaching distribution footprint across the world.

IDEXX is also one of the larger providers of digital imaging equipment and practice management software for vet practices, as well as of water testing solutions. Furthermore, the reference lab business is essentially a duopoly dominated by IDEXX and Antech (a subsidiary of Mars Inc.). Together, these two companies control about 90% of the market in the United States. This duopoly is so overbearing that many veterinarians are accusing the two incumbents of using abusive contracts to sell lab services at higher prices. There is a possible downside to IDEXX's dominance because such a prominent position naturally creates more opportunities for loss than gain.

4. Is IDEXX present in attractive markets offering clear growth runways? Yes: 1 Point

IDEXX operates within a structurally attractive field: for example, due to regulatory and other constraints, it is generally simpler and cheaper to produce and sell products targeted at the animal population than at the human population (indeed, while the pet health sector is still highly regulated, the regulatory framework is not as burdensome as its human counterpart); and unlike the situation affecting medical products for humans, experimental veterinary products can be swiftly evaluated in the animal species under inspection; furthermore, veterinary products tend to exhibit longer replacement cycles, a fact that mitigates the need for heavy and constant R&D outlays.

For veterinary practices specifically, adding new diagnostic modalities to a clinic's business plan often makes economic sense, as new equipment from state-of-the-art providers like IDEXX can create new revenue sources or enhance current ones (especially when diagnostic results are found quickly). Veterinary medicine is also a straightforward cash-based business that doesn't suffer from the uncertainties surrounding healthcare reform (or from the attrition levied by the presence of third-party payers) - as a consequence, IDEXX is not overly exposed to margin pressure, bad debt, protracted contract negotiations, and third-party payer risk.

As discussed above, IDEXX is also the top dog in veterinary diagnostics. However, the company states that it has only penetrated about 5% of its estimated USD 33 billion addressable market. Opportunities for further growth should, therefore, be plentiful. Moreover, and based on its historical rate of expansion, the company projects that its wider market could grow at a healthy CAGR of approximately 8% for the next quarter of a century. The main factors propelling this prolonged growth are the increasing populations of companion and farm animals, pet humanization, rising pet ownership, and swelling demand for animal protein.

Growth Drivers | Humanization of Pets and Increasing Pet Ownership

According to the American Pet Products Association (APPA), about 68% of households in the United States now have a companion animal, up from 58% in the late Eighties (today, there are roughly 90 million dogs and 94 million cats in the country). Owners of these companion animals progressively recognize pets as members of their family and are therefore willing to provide them with luxury services, comprehensive insurance, expensive foods, and advanced healthcare.

This relatively novel phenomenon is being further reinforced by the newer generations and by their views, lifestyle, and behaviors: for instance, as they postpone marriage and parenthood, about 43% of Millennial consumers now perceive pets (quite literally) as their 'fur babies' and about 71% of them would accept a pay cut to take their companion animals to work every day. Tellingly, consumers in the United States spend more on cats and dogs than they do in auto insurance.

Moreover, according to IDEXX, about 42% of Millennials and Generation Z consumers consider that their pets have special health needs, a view that is shared by only 19% of Baby Boomers. Millennials also take their pets to the vet about 3.3 times per year, while Generation X consumers and Baby Boomers only do the same 2.6 times per year, on average (in fact, in the not so distant past, many owners only took their pets to the veterinary when the animal was dying). Millennials are the largest pet-loving generation of all time - in addition to other species of animals, nowadays about 35% of them have cats and 38% have dogs (notably, in cities like San Francisco, there are more dogs than children). These trends are not exclusive to the United States, as pet ownership is on the rise pretty much across the world and both in developed and developing nations.

The number of cats and dogs worldwide is now expected to grow by 18% and 22%, respectively, through to 2024. At present, for example, only 8% of families in China's tier-1 and tier-2 cities own pets; however, with a population urbanizing at a rate of over 30 million people per year, this percentage is expected to increase meaningfully in the future. Why? Because according to some sources, as the people population in China is controlled by authorities, urban dwellers are probably viewing companion animals as a kind of 'substitute' for children. If current trends persist, China may surpass the United States as the world's largest pet market over the next decades. Other populous markets seeing fast-growing pet ownership include India, Russia, Japan, Brazil, and Vietnam (in all of them, diagnostic utilization is still at an early stage).

And since these companion animals are generally living longer, they are at increased risk of developing 'profitable' age-related conditions such as diabetes, osteoarthritis, or renal insufficiency. Furthermore, in the United States, about 56% of dogs and nearly 60% of cats are obese or overweight, a fact that increases their disease burden (in a number that reveals the extent of this problem among some populations of pets as much as 1 in 3 urinalyses in 'wellness visits' to vets have clinically-significant findings, according to IDEXX). Thus, as it occurs with their human owners, chronic conditions in animals are creating a very lucrative market for companies like IDEXX.

Veterinarians also recommended regular testing for many of these common diseases, a fact that should promote high and consistent demand for IDEXX's offerings. In addition to this, the reference lab business is being consolidated at a fast clip in the United States, a fact that should promote rational competition and stable prices between Antech and IDEXX (external testing is a USD 2.6 billion industry that is expected to generate double-digit growth through to 2026). Following the trends in human health, and its new focus on prevention, many animals are now subjected to regular testing throughout the year as opposed to the practice of testing only when the animal is thought to be sick; besides, for a given disease to be correctly diagnosed in an animal, it is often necessary to consume a vast arsenal of diagnostic solutions, as pets cannot express in words what they are feeling.

As the focus shifts to preventive care, wellness plans and pet health insurance should also increase the demand for veterinary services - for example, in countries like the UK, insurance increases both the frequency of clinical visits and the utilization of diagnostic tests. With only about 1% of companion animals in the United States enrolled in pet health insurance, this underpenetrated market can contribute meaningfully to IDEXX's future growth trajectory. And what about the effect of the current COVID-19 crisis on pet ownership? Well, according to sources like the Washington Post, many in the United States are turning to pets to cope with self-isolation. Will the crisis boost pet ownership over the long-term? It is too soon to know, of course; but, as attested by animal rescuers across the country, there has been renewed and widespread interest in the adoption and fostering of companion animals.

Growth Drivers | Expanding Poultry and Livestock Population

According to the WHO, the world's poultry and livestock sectors are growing at an exceptional rate on the back of surging demand for animal protein. Annual meat production is now expected to increase from about 218 million tons in 1998 to 376 million tons by 2030. The main driving force behind this surge is a combination of urbanization, population growth, and rising incomes in developing countries. On top of this, many countries are trying to improve the productivity of livestock, and some of them - such as Russia or Saudi Arabia - are subjected to government mandates for self-sufficiency.

Despite the ongoing shift to veganism in the West, this rising demand will also impact developed countries like the United States: according to the USDA, production of beef is anticipated to increase by nearly 4% per year, while boiler meet and beef exports are expected to grow by 7% and 9%, respectively. This is expected because, for the large majority of people in the world (particularly in developing geographies), animal protein remains a highly desired food for taste and nutritional value.

In broader terms, the FAO estimates that the number of livestock animals will rise from 4.1 billion in 2015 to 5.8 billion in 2050 on a worldwide basis. Because 2 out of every 5 of these animals will be born in Africa - a continent where general animal healthcare standards are still much lower than in developed regions - IDEXX still has a large and largely untapped market to explore over the coming decades.

Higher per capita consumption of meat, eggs, and dairy products is anticipated to become especially conspicuous in countries such as India, Brazil, and China. But animal healthcare standards in these immense nations are also, in general, subpar. For instance, on a per capita basis, China (which is the global leader in pork production) only spends USD 4.4 on veterinary services while the United States spends USD 127. Now, as China closes the gap with developed nations, the demand for veterinary services will certainly rise. This is largely unavoidable because the animal-to-animal transmission of serious diseases - like African swine fever - can only be controlled through very strict hygiene standards.

But there is also widespread anxiety about the impact of industrial meat production on animal-to-human disease transmission. Aggressive bacterial species that can infect humans (such as Salmonella and Campylobacter, which can be detected by IDEXX's tests) have the capacity not only to contaminate food products but also the environment around farms and slaughterhouses.

In the wake of the COVID-19 crisis, authorities throughout the globe are equally under pressure to apply sterner veterinary protocols. At long last, the crisis highlighted the need to closely monitor a plethora of new zoonotic diseases such as MERS (Middle East Respiratory Syndrome), which is yet another coronavirus-induced condition that affects bats, camels, and humans. Worryingly, MERS kills 3 or 4 out of every 10 human patients and is recognized by the WHO as a possible cause of a future pandemic. Such continuous emergence of novel pathogenic agents in animals, and their contagion to humans, will surely boost the wider animal healthcare market globally. Given all these trends, threats, and statistics, it is difficult to imagine a future scenario in which IDEXX fails to prosper (more on that later).

5. Is IDEXX well protected against systemic and company-specific risks with the potential to severely compromise its future? Yes: 1 Point

Macroeconomic Headwinds: Because it mostly depends on discretionary spending, the companion animal healthcare market is not as impervious to cyclicality as some investors might assume. The Financial Crisis, for instance, had a negative impact on revenues for many companion animal veterinary practices in the US. Now, with the ongoing economic predicament, cash-strapped pet owners can become hesitant to spend money on non-urgent diagnostics, and practices can also become reluctant to purchase or upgrade equipment. And, since IDEXX derives 38% of its total revenues from international markets, a strengthening of the US dollar would have a sizable impact on the company's top line and cash flows.

On the other hand, it should be noted that the US economy was still able to add new pet stores even during the Financial Crisis. Furthermore, due to its leading-edge offerings and sticky relationships with customers, IDEXX was barely (if at all) affected by the previous recession. Now, it is to be believed that the pet humanization trend and IDEXX's manifest strengths - including its reliance on recurring revenues - will again mitigate to some extent the effects of the current COVID-19 crisis.

Technological Disruption: IDEXX is an innovation powerhouse. However, by itself, constant innovation is rarely a source of enduring competitive advantage. Indeed, capitalism's creative destruction ensures that most companies must act like Lewis Carroll's famed Red Queen: they must run (i.e. innovate) as fast as they can just to stay in the same place. Capitalism guarantees that innovation is never an exclusive prerogative of any particular company - therefore, it should be only a matter of time until other innovative rivals start an assault on IDEXX's attractive dominions.

One example is provided by Zoetis (ZTS): along with its acquisition of Abaxis (a direct competitor to IDEXX), Zoetis has launched roughly 1100 new products over the last 5 years, including innovative diagnostic solutions like its Witness Lepto test for the early detection of leptospirosis. And, unlike IDEXX, Zoetis can integrate the diagnostic and therapeutic components of animal healthcare. To supplement the acquisition of Abaxis, Zoetis is also expanding its diagnostics franchise with the purchase of ZNLabs and Ethos Diagnostic Science (two reference lab businesses). Zoetis is looking to strengthen its portfolio across the continuum of care and enhance its value proposition to veterinary practices (however, as a newcomer to the diagnostics space, even a monster like Zoetis will find the going tough). On the other hand, a capable company like Neogen (NEOG) already possesses the industry relationships and perhaps the technical know-how - in urinalysis, for instance - to challenge IDEXX on its turf.

Sooner or later, competitors will start to offer competing solutions with greater diagnostic accuracy, greater ease of use, or lower prices. Rivals can also gain a foothold in promising markets by introducing products for unmet needs in animal health. Nevertheless, due to its entrenched position and widening competitive gap, IDEXX won´t be easily disrupted.

Acquisitions: Large M&A deals tend to destroy value for the acquiring firm. Fortunately, IDEXX has been deploying less than USD 50 million on acquisitions per year - and, in general, these have been small tuck-in or technology acquisitions within or adjacent to IDEXX's core. The company has bought several niche companies over the past few years (like RADIL and Smart Flow), but such acquisitions were made at reasonable prices as implicitly demonstrated by the low levels of goodwill on IDEXX's balance sheet. Management seems to be ready to abandon potential targets when they are not accretive to value. Instead, excess capital has been allocated to share repurchases; it can be argued, though, that the company has been repurchasing shares at a significant premium.

Leadership Changes: Transitions in leadership are often a cause of concern for shareholders (and even more so when the outgoing CEO proved decisive to a company's outperformance). IDEXX is under new management since late 2019 when Jay Mazelsky replaced Jonathan Ayers at the helm. The transition was smooth, though, and Mazelsky (an old hand at the company) is expected to remain focused on the effective strategies that made IDEXX so successful over the past.

6. Is IDEXX a superior cash-generative business? Neutral: 0 Points

Warren Buffett once said that "To value something, you simply have to take its free cash flows from now until kingdom come and then discount them back to the present using an appropriate discount rate. All cash is equal. You just need to evaluate a business's economic characteristics." And, among those economic characteristics, one of the most crucial is precisely the amount of cash a company can generate from now until kingdom come - obviously, a superior cash-generative company should be more valuable than an average one. Moreover, by focusing the attention on cash, it becomes easier to grasp a firm's true financial performance (as profits are not always real). Here, by inspecting the following parameters, the purpose is to assess IDEXX's potential to produce hard cash from sales and inputs.

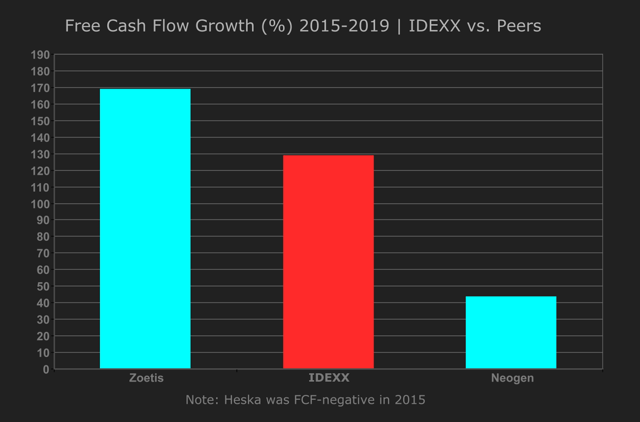

IDEXX | Free Cash Flow Generation & FCF per Share: IDEXX has always been Free Cash Flow-positive over the past decade, a period through which cash flow generation increased by a healthy 117% (from USD 140 million in 2010 to USD 304 million in 2019). On a per-share basis, FCF has improved by 182% over the same period as the company aggressively repurchased shares and became more efficient. However, within the chosen peer-group*, Zoetis performed even more remarkably, as its FCF generation increased by 168% since the IPO in 2013.

*Please note: IDEXX's chosen peer group will include Zoetis, Neogen, and Heska (HSKA). Neogen is a company focused on veterinary diagnostics that can be an interesting play on the growth trends surrounding the market. Other peers - like Covetrus (CVET) - won't be included in this analysis due to its short operational records.

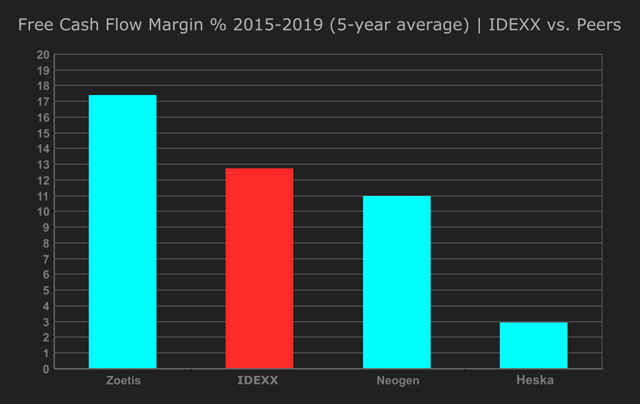

IDEXX | Free Cash Flow to Sales (5-year average): Since it indicates what percent of revenue is left for investors in the form of free and discretionary cash flow, this parameter should always be closely scrutinized (especially during an economic downturn like the one we're experiencing right now) - in practical terms, if a firm sells a product or service for 1.0 USD, the FCF margin identifies how many cents an investor can take home without suffocating the company's cash flow. In this context, it is agreed that FCF margins above 10% usually point to a high ability to transform sales into true liquidity. IDEXX's FCF/Sales (TTM) ratio now stands at a solid 12.6%; however, Zoetis tops the peer group here again, as its 5-year average FCF margin is a rather impressive 17.4%.

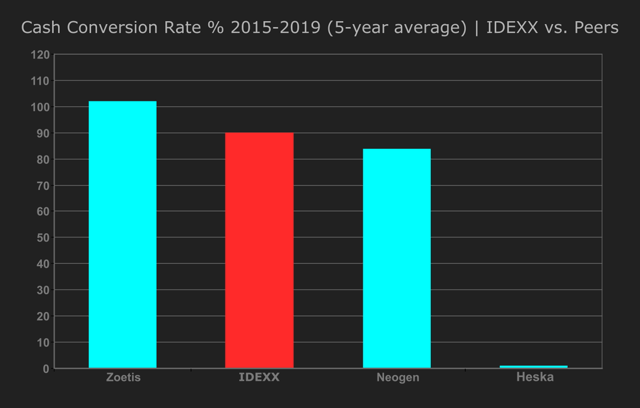

IDEXX | Cash Conversion Rate & Cash Conversion Cycle: As measured by Free Cash Flow/Net Income, the CCR provides a way to assess the discrepancy between a firm's cash flows and net profits (said differently, the CCR indicates what percentage of profits actually arrives in cash). IDEXX's CCR averaged only 90% between 2015 and 2020. This is not a low percentage in an absolute sense (at least when compared to many firms within the S&P500).

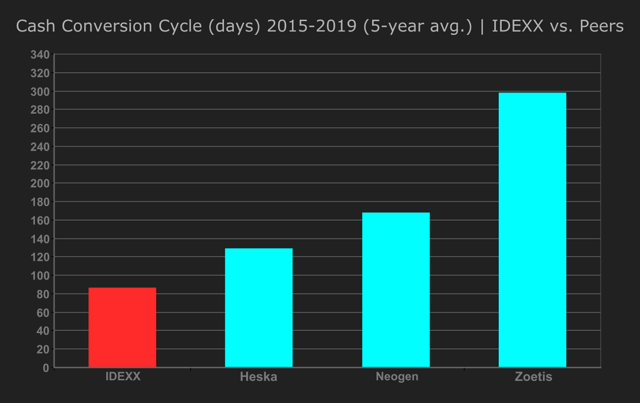

Still, a cash conversion higher than 100% would be a rather more desirable result for a mature company like IDEXX: when FCF is larger than Net Income (translated into a CCR > 100% in any given year), cash earnings are higher than accrual earnings, which means that a company's earnings quality is high. As shown above, Zoetis' quality of earnings is of the highest grade. On the flip side, and in contrast to Zoetis, IDEXX only needed 91 days to convert resource inputs into cash flow, making it the company with the faster cash conversion cycle by a comfortable margin.

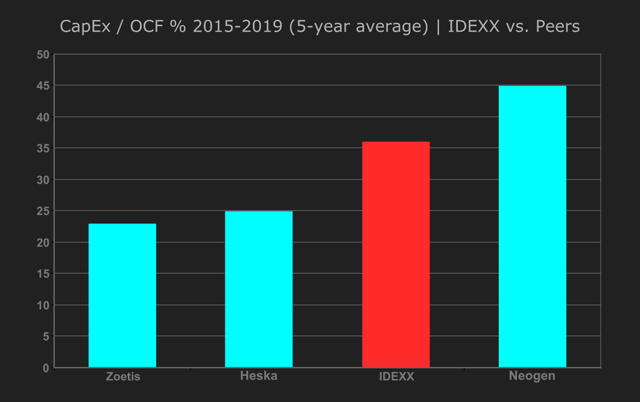

IDEXX | CapEx/Operating Cash Flow (5-year average: Colin Bruce Chapman (the celebrated engineer behind Lotus sports cars) famously stated that to win races, he didn't have to add new, more powerful motors or other fancy stuff to his cars; all he needed was to "add lightness". The same can be said regarding businesses: in very general terms, capital-light business models have a faster speed of execution, greater operational flexibility, better returns on capital and lower profit volatility; besides, they can often achieve higher scale-driven cost savings than heavier models - being so, capital-light businesses should be better prepared to withstand economic shocks like the one unleashed by the COVID-19 crisis (however, such businesses can be tougher to control and manage, and they are at a higher risk of leaking intellectual property). So, is IDEXX a capital-light business? Judging by its CapEx/OCF ratio it surely is, as CapEx only consumed a little over one-third of IDEXX's OCF during the past 5 years (up from 26.2% for the previous rolling 5-year period). Still, Zoetis and Heska have been even lighter.

7. Has IDEXX maintained high average Cash Returns On Invested Capital over the last 10 years? Yes: 1 Point

"We want to buy a great business, defined as having a high return on capital for a long period of time, where we think management will treat us right. We like to buy at 40 cents on the dollar but will pay a lot closer to $1 on the dollar for a great business". (Warren Buffett)

Bought at a fair price, high-quality companies can deliver market-beating returns without undue risk. Indeed, companies that generate high and sustainable returns on invested capital (in cash, preferably) can compensate for many sins, including the capital sin of buying them without a very wide margin of safety. And that's because such companies are capable of creating tangible value both during good and bad years (like, maybe, 2020).

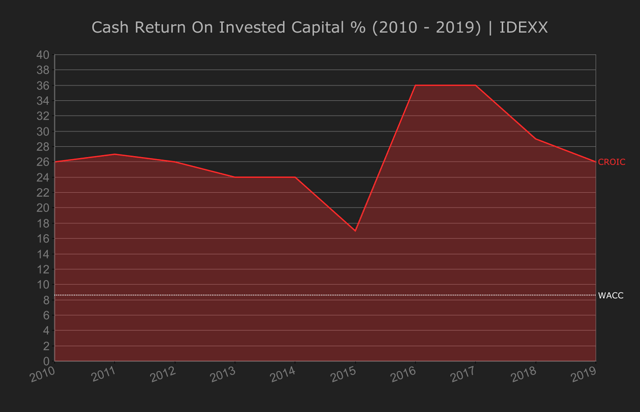

As shown above, IDEXX's cash returns* have always exceeded comfortably its estimated weighted average cost of capital (WACC) over the past 10 years - no doubt Warren Buffett would be quite happy with IDEXX's performance on this front, as the company's outstanding results dwarf the ~10% returns that have been the long-term historical average for public companies in the United States. Of course, 'great businesses' like IDEXX sometimes underperform in sharply rising markets (such as when the economy is recovering from a recession) because lower-quality firms tend to do comparatively well as they surge from a beaten-down state. Still, in times like these, nothing beats quality.

*Here, the calculation of returns on invested capital followed the methodology proposed by Michael Mauboussin but Free Cash Flow was used instead of NOPAT in the numerator. The objective is to assess how much actual cash the company generates based on each dollar it invests into its operations.

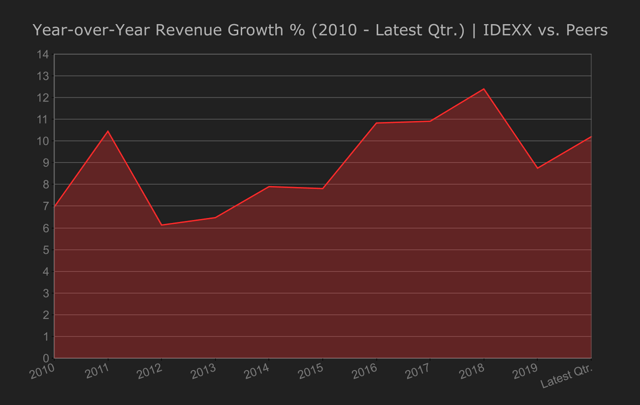

8. Has IDEXX been able to consistently increase sales over the past 10 years? Yes: 1 Point

The ROIC-WACC spread is one of the key drivers of value; the other is sales. It is no wonder then that IDEXX has been a compounder of value throughout the last decade - over that period IDEXX's sales grew by 118%, whereas the veterinary healthcare market as a whole only grew by about 70%. In contrast to Heska and Zoetis, the company never recorded a year with negative sales growth over the last 10 years of operations. This implies that IDEXX is either capturing share from rivals or creating new niches within its marketplace.

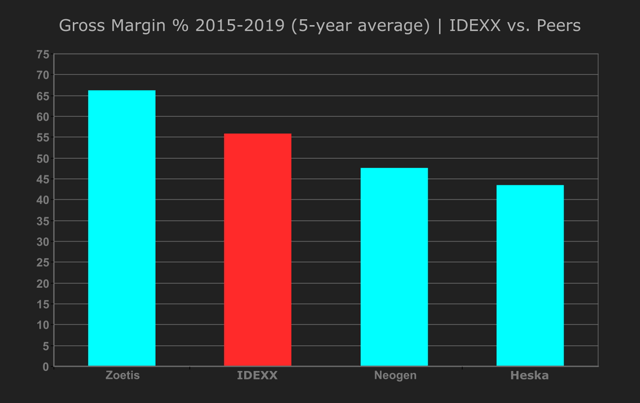

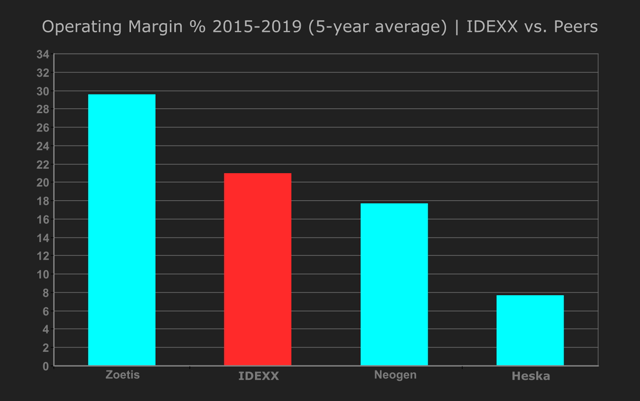

9. Does IDEXX exhibit a high degree of pricing power? Yes: 1 Point

Gross margins are frequently viewed as a rough measure of pricing power. As seen below, the firm with higher average gross margins within the peer group is Zoetis; however, this doesn't necessarily mean that Zoetis (essentially, a producer of therapeutic products) has more pricing power than IDEXX (a producer of diagnostic products). In reality, IDEXX's true direct competitor in diagnostics is Abaxis, a company that generated average gross margins of 54.5%-55% before being acquired by Zoetis in 2018. Abaxis' gross margins as a standalone company were not significantly different from IDEXX's current margins.

Moreover, as an indicator of pricing power, gross margins are probably more applicable to "old economy" manufacturers than to modern manufacturers: after all, for knowledge-based businesses like IDEXX, pricing power arises primarily from the markup between charged price and the costs imposed by the development of intellectual property (which is obtained mainly via R&D, an item included in the assessment of operating margins), and not from the markup between charged price and the costs of raw materials, undifferentiated labor and so on (which are variables included in the calculation of gross margins). Thus, to estimate IDEXX's pricing power, operating margins are arguably at least as important as gross margins. Here too, Abaxis' previous operating margins (which averaged 19.8% between 2013 and 2017) are not very dissimilar to IDEXX's current margins.

And, of course, both market share fluctuations and returns on invested capital also need to be taken into account when estimating pricing power (because, by definition, a company cannot have true pricing power if competitors are capturing its customers and economic profits). Consistently gaining market share from rivals comes with unwanted attention; besides, outsized economic profitability inevitably attracts new players to the industry and forces all firms to emulate best practices (or wilt and die in the process).

These events result in a reversion to the mean of ROICs. Yet, IDEXX's returns on capital easily exceed its estimated WACC; furthermore, and judging by its solid sales growth, the company seems to be capturing market share across most end markets. If all these parameters need to be taken into account, how can we estimate IDEXX's (year-over-year) pricing power relative to rivals? Well, we can use a simple and dirty heuristic* stating that:

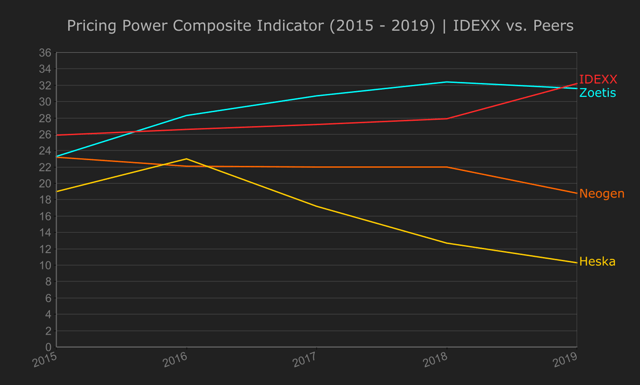

Pricing Power = (Gross Margin + Operating Margin + ROIC + Sales Growth)/4

Please note that this unorthodox equation is not based in any established theory (other heuristics like the famous 'Rule of 40' are also fuzzy constructs, but they are useful nonetheless); instead of striving for accuracy, this equation - call it 'Pricing Power Composite Indicator', for instance - only intends to provide a rough sense of the magnitude and general trajectory of IDEXX's pricing power through the years. The jugular question is how much weight should be given to each parameter- but, for now and for simplicity's sake, let's give equal weight to every variable and then calculate the pricing power over the past 5 years of all the companies within the peer group using the equation above.

*A heuristic "is any approach to problem-solving or self-discovery that employs a practical method that is not guaranteed to be optimal, perfect, or rational, but which is nevertheless sufficient for reaching an immediate, short-term goal".

The heuristic shows that Zoetis has been the company with the most pricing power over the past half-decade - but IDEXX hasn't been far behind. Indeed, one of IDEXX's guiding principles is to maintain "premium pricing, including by effectively implementing price increases, for our differentiated products and services through, among other things, effective communication and promotion of the value of our products and services in an environment where many of our competitors promote, market and sell lesser offerings at prices lower than ours". This excerpt shows that IDEXX is not willing to compete based on lower prices (quite the opposite) and that it recognizes that other companies sell "lesser offerings" (compared to its innovative offerings).

There can be no doubt that IDEXX's main differentiator is its capacity to consistently innovate. One recent example of meaningful innovation is the company's new rapid cytology service, which is powered by a new in-clinic instrument and by IDEXX's VetConnect PLUS software. This service digitally connects veterinary practices to the largest global network of clinical pathologists, enabling vets to receive vital cytology interpretations within only 2 hours.

Another example is provided by IDEXX's SDMA, a test intended to identify renal disease in cats and dogs. Through conventional bun/creatinine tests, renal disease is often not detected until about three-quarters of the kidney tissues are irreversibly damaged; with SDMA, though, detection can occur much earlier (when only about one-third of the kidneys are affected) to the benefit of clinical outcomes. Through interpretative aids built into its analyzers, IDEXX is also starting to harness artificial intelligence/neural networks to provide instant diagnostic support for veterinarians: for instance, within 3 minutes, the company's SediVue Dx Urine Sediment Analyzer leverages the collective lessons of hundreds of millions of patient images to guide clinical decisions and identify pathologic changes.

The company's tests (such as IDEXX's SNAP tests for infectious diseases) are also trusted and renowned for their accuracy, as confirmed by highly favorable customer advocacy and peer-reviewed studies. To create such trusted and groundbreaking offerings, IDEXX invests substantially more in R&D than all of its direct competitors pooled together - remarkably, the company is responsible for a staggering 80% of all of the identifiable R&D spending in veterinary diagnostics (that is, IDEXX invests USD 75-80 for each 100 USD invested in R&D within the larger veterinary diagnostics field). These investments have maintained the Maine-based firm at the forefront of a growing market where it faces relatively low levels of competitive attrition; this, in turn, has enabled IDEXX to capture market share and charge premium prices for its offerings.

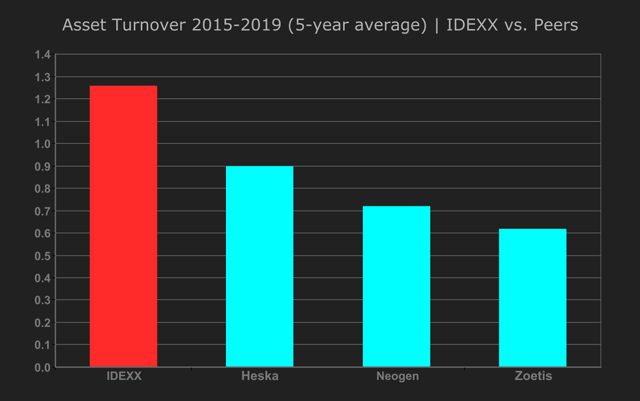

10. Is IDEXX highly efficient and productive relative to its assets? Yes: 1 Point

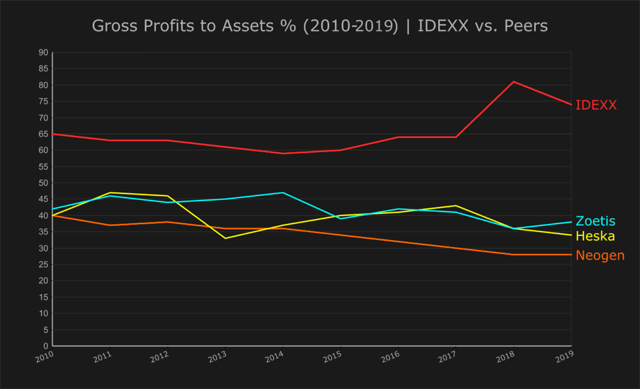

Companies with high gross profitability tend to generate higher returns than firms with low gross profitability ('gross profitability' is the ratio between a firm's gross profits and its total assets). It is clear that this ratio punishes firms with bloated balance sheets and rewards companies that realize abundant profits from their asset base (here, gross profits are used instead of earnings because they are viewed as a less unadulterated measure of economic productivity). Depending on the context, this calculation should also take into account the presence of high levels of cash on the balance sheet - otherwise, an investor could be fooled into thinking that companies like Google (GOOG) or Microsoft (MSFT) are very unproductive when they are nothing of the sort. In general, and depending on the industry, the most productive companies tend to display gross profitability ratios higher than 33%.

The image above shows that IDEXX has always managed to stay above the minimum 33% threshold of productivity over the recent past. It also indicates that, among its peers, IDEXX has been the most productive company relative to its total assets (by far). This encouraging result is reinforced by IDEXX's high intra-industry asset turnover - defined as sales divided by assets - which is a reflection of the company's superior operating efficiency: relative to its asset base, IDEXX is both very efficient and very productive.

11. Is IDEXX financially strong? No: - 1 Points

IDEXX's Altman Z-Score of 11.7 places the company well inside the so-called 'safe zone' and nowhere near insolvency. IDEXX also displays a quite strong Piotroski F-Score of 8 (out of 9) that is being penalized only by higher year-over-year gearing (long-term debt divided by average total assets); still, the amount of this leverage seems slightly disproportionate given IDEXX's debt-to-equity ratio of 4.32 and debt-to-capital ratio of 0.83. In effect, long-term debt and other long-term liabilities account for more than half (50.7%) of the company's total current liabilities. It is possible, however, for a company to make interest payments comfortably even though it exhibits inflated levels of debt: even if IDEXX's cash-to-debt ratio stands merely at 0.11 (latest quarter figures show that cash & short-term investments make up a paltry 4.9% of the company's total assets), IDEXX's operating income can still cover comfortably (17.8x) the firm's interest expense. Standing at 0.94 and 0.55, respectively, IDEXX's Current and Quick Ratios are not that brilliant either. IDEXX's financial position is not fragile; still, the company does not possess a fortress balance sheet at this challenging time.

IDEXX | Valuation

Relative Valuation: With a free cash yield of only 1.95% and an earnings yield of 1.82%, IDEXX surely looks expensive at the moment. The market is projecting a very enthusiastic - and probably unrealistic - growth rate on the part of the firm. According to several sources (including the company itself), the veterinary diagnostics market is expected to witness an average CAGR of about 8% over the next few years; however, averages do not account for the fact that growth is seldom smooth and linear (moreover, these estimates do not include the impact of the pandemic on the global business environment); to justify IDEXX's recent price multiples, though, the company would have to grow sales by about 11%-12% per annum through to 2025. Is this possible? Anything is possible, of course. However, this 'field of dreams' approach rarely pays off. In reality, the company 'only' grew revenues by an average of 8.12% per annum between 2010 and 2019 (and yet IDEXX managed to achieve sales CAGR of 12% in 2015-2019); will sales growth really remain unchanged over the next 5 years? Granted, this is a high-quality name, but valuation still needs to be grounded in reality. And is there a takeout premium baked into the price? Maybe. But that's also a speculative assumption.

Absolute Valuation (Discounted Cash Flow Analysis) | Main Assumptions

Revenues: Innovative offerings, further cross-selling of products and services, an expanding installed base of equipment, and wider international penetration should all enable the company to disproportionally capitalize on the opportunities provided by pet humanization and increased ownership. IDEXX estimates that there are about 72.500 additional worldwide placement opportunities for its chemistry analyzers, and a further 33.000 and 94.000 placement opportunities for the urine and hematology analyzers, respectively; what's more, because zoonotic diseases are a serious and mounting problem associated to the human quest for animal protein (as explained on the conclusion below), IDEXX should also be able to expand meaningfully its Livestock, Poultry and Dairy (LPD) business over the medium- to long-term. Both the LPD and Water segments tend to generate higher margins than the vastly larger CAG segment. However, the COVID-19 crisis is still expected to exert a negative impact on IDEXX's revenues up to 2022-2023 - perhaps incorrectly, the model then assumes that it will take a minimum of 3-4 years to 1) develop an effective vaccine against COVID-19; 2) immunize large segments of the world's population; and 3) finally restore a semblance of self-sustained growth to the global economy. As a consequence, the updated model assumes sales growth of 2%-4% in 2020-2021, a reacceleration of revenues to 4%-6% in 2022-2023, and finally, a further reacceleration to 7%-9% in 2024.

Gross and Operating Margins: Conservatively, the model assumes that gross margins will stay within the 55.0%-56.0% range over the next 5 years (slightly down from 56.0%-56.5%, as projected on the article published in August 2019). IDEXX was in a good position to deliver average annual gross margin expansion of 80-120 basis points in the external lab business, and company-wide operating margin expansion of 50-100 basis points; however, in addition to the effects of the current crisis, Zoetis is also building up its diagnostics and reference lab businesses, which means that IDEXX will have to ramp up its efforts on the R&D and sales fronts over the next 5 years. Productivity gains and better cost controls shouldn't be enough to completely offset these competitive and macroeconomic pressures; being so, the model also expects operating margins within the 21%-22% interval (down from 22.5%-23.0%).

Operating Cash Investments: The model assumes that the sum of capital expenditures investments with the changes in working capital will reach a level equivalent to 10%-15% of revenue, on average, per year (up to 2024 - eventually, capital spending should normalize at 5% of revenue); it also estimates that invested capital will reach an amount equivalent to 22%-23% of free cash flow, on average, per year, in line with the company's investments over the preceding decade.

Cost of Capital, Terminal Growth Rate and Fair Value Estimate: The DCF model assumes a WACC within the 8.5% + [± 1.5%] range. The model also assumes a terminal growth rate between 1% and 2%. Subsequent to a sensitivity analysis, the valuation model delivers a present-day fair value estimate range between USD 130 and 156 per share, implying that IDEXX is again overvalued.

IDEXX | Conclusion

Some 11.000 years ago, somewhere in the Middle East, some humans took a monumental decision: instead of hunting and gathering their food across a large expanse of wilderness, these humans decided to grow and raise their own food within a limited geography. They became farmers and pastoralists - the Neolithic had begun. That was also the beginning of a revolution that would later give Humanity things like cities, countries, mathematics, alphabets, wheels, professions, inequalities, politics, philosophies, antibiotics, vaccines, computers and the mighty Saturn V rocket that propelled Neil Armstrong towards the Moon - in short, this decision gave us Civilization.

However, over time, and according to the story written in their bones, these farmers became smaller, less muscular, and frailer than the hunter-gatherers living nearby; among other changes, and paradoxically or not, their brains also shrank. These anatomical alterations seem to indicate that Neolithic people had a higher disease burden than their Paleolithic brethren. Why? Probably because their food was not as varied and nutritious as the food of the hunter-gatherers and also because…newly domesticated animals transmitted novel acute and chronic diseases to these recently 'civilized' humans (wildlife did not transmit diseases effectively to hunter-gatherers because they didn't live side by side with large concentrations of cloistered animals; besides, because hunter-gatherers lived isolated in small groups, widespread contagion chains were less likely to occur).

Farm animals brought with them many of the most deadly scourges of Humanity: for instance, chicken gave us chickenpox and shingles; cattle gave us tuberculosis, anthrax, measles, and smallpox; and pigs gave us influenza (including probably the horrendous 1918 Flu Pandemic: pigs could have been the 'mixing vessel' that allowed an avian virus to make its way into the lungs of humans).

But the domestication of the animals that would become dogs (a species appropriately named Canis familiaris) started sooner than that of farm animals. In fact, the relationship between ancestral dogs and hunter-gatherers probably dates back to the Upper Paleolithic, at a time when much of Eurasia and North America were still covered by a thick mantle of snow and ice. In a sense, this relationship was forged in steel by the unforgiving environmental conditions shared by the two species - by working and bonding together in that frozen world, dogs and humans became better hunters, better (mutual) protectors and better procreators of their respective offspring - still today, we trust our guard dogs to protect our children, and still today we trust our dogs to hunt down wild animals and terrorists. Because it involves not only strict biological elements but also cognitive and psychological elements, such a deep and intimate relationship between two very different species of mammals is unprecedented in Nature.

Indeed, the bond between many dogs and their owners is unwavering, unbreakable, and full of reciprocal empathy. Giving our long shared history and cherished relationship, it is only fitting, then, that the newer generations of humans are now considering their dogs as full members of the family - and, of course, this 'pet humanization' phenomenon is the culmination of a primordial process that is bound to benefit a company like IDEXX (and, to be fair, many other companies within the veterinary market).

But there's also a downside to this long-lived connection between dogs and human beings, as our shared evolutionary pathways also made both species the communal breeding grounds of many mutual diseases. Indeed, the number of parasites and other pathogens shared by people and certain animals is directly correlated to how long those animals have been domesticated: nowadays, humans and dogs can be co-infected by at least 71 shared parasites (because we've been living together for about 17.000 years), whereas humans and cattle can 'only' be co-infected by a little over half that number (because we've been living together for 'only' 11.000 years). So, in more ways than one, the health status of our dogs (and of our cats, to a slightly lesser extent) really has, or can have, a disproportionate effect on our own health status. Again, this plays right into the hands of those businesses, like IDEXX, whose purpose is also to identify pathogens that can be transmitted between animals and between animals and humans.

Indeed, about three-quarters of all infectious diseases are the result of these so-called 'zoonotic spillovers'. And, although wild animals may be significant for the transmission of new diseases to us (as exemplified by the appearance of Ebola, AIDS, and COVID-19, for example), Humanity's oldest companions - dogs, cats, pigs, cows and so on - are still the main sources of zoonotic diseases. It is noteworthy that common animal-to-human diseases (such as leptospirosis, tuberculosis, and brucellosis) kill over two million people each year still today.

Many of these deadly diseases can be detected through veterinary tests; and many of these tests (ever faster and more accurate) are provided by IDEXX on a worldwide scale. Being so, and despite its relative anonymity among some individual investors, IDEXX is at the forefront of markets with tremendous implications for sustainability and food security, as well as for human and animal health.

Animal health will always have a profound effect on the faith of human beings and the zoonotic COVID-19 is a timely, albeit tragic, reminder of this assertion. At long last, with COVID-19, rich countries in the West have awakened to the fact that Humanity and Civilization need a more robust global monitoring system to test, identify and mitigate emerging diseases with pandemic potential. If you, in Europe or North America, don't think that such a system is critical, well, you'd better think again - we must remember that, between 2010 and 2020, millions of people across Asia, Africa, and Latin America were affected by repeated outbreaks of Zika, MERS, Chikungunya and new, deadlier strains of Ebola (among many others).

The advent of these novel diseases is much more frequent than many people in Europe or North America realize. Globally-coordinated pandemic preparedness is therefore of the utmost importance because, sooner or later, Humanity will certainly face a much deadlier virus than SARS-CoV-2: some avian influenza viruses - like the H7N9 virus, for example - can cause infections in humans with a CFR (Case Fatality Rate) of 40%-65%. Such CFR is orders of magnitude higher than the CFR of COVID-19.

We'll all be in the grimmest of predicaments if these viruses figure out how to efficiently travel between human beings. But they will, eventually. Indeed, the previous article on IDEXX already voiced these concerns when it mentioned the probable arrival of a new pandemic agent called 'Disease X'. Specifically, the article stated that "(…) Disease X is not an identified disease, but rather a hypothetical one that will be triggered by a pathogen that we don't yet realize impacts human beings (it is an inevitable outcome because Mother Nature strives to keep unbridled populations in check including, obviously, human populations). It will likely be a zoonotic disease (…)". Little did we know that this Disease X (as named by the WHO) would make its appearance in China only four months after that article was published. This was not prescience, of course. Rather, the article only recognized that odds were, and still are, stacked in favor of novel pathogens.

Our collective awareness of this problem, as well as the mounting incidence and prevalence of zoonotic diseases, will surely boost the demand for innovative diagnostic products to detect, monitor, and limit the occurrence of pandemics and epidemics. If this crisis has shown us anything, it is that good public health, good animal health and good surveillance mechanisms are critical investments for our common good (and not expenses: we all need to sign some sort of petition and pressure our governments to take decisive, globally-coordinated action along this front so as to effectively prevent human and economic calamity in the future). This, in turn, will surely benefit a proactive and innovative company like IDEXX - tellingly, as a proof of its innovative credentials, IDEXX was one of the first companies to develop a test to identify COVID-19 in animals (as we don't want our cats, dogs, and ferrets to become reservoirs of the virus).

Given its technological prowess and diagnostic experience with pets, poultry, and livestock, it is hard to picture a global monitoring system in which IDEXX fails to play a role. IDEXX is an important company that will continue to grow and prosper on the back of its importance to people and animals. It is also a great business, as confirmed by its Quality Score of 8 (out of 11 possible points). Indeed, this company has plenty of fight left in it to emerge even stronger from the COVID-19 crisis: IDEXX consistently executes, has a very high market share (but also ample opportunities for long-term growth), is in a market surrounded by effective barriers to entry and has outstanding recurring revenue streams. The company remains expensive, though. But keep it in your watchlist and be ready to pounce when the opportunity arises (maybe during the next pandemic).

Thank you for reading.

Disclosure: I am/we are long IDXX, ZTS. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

https://ift.tt/3d2p5UY

Comments

Post a Comment